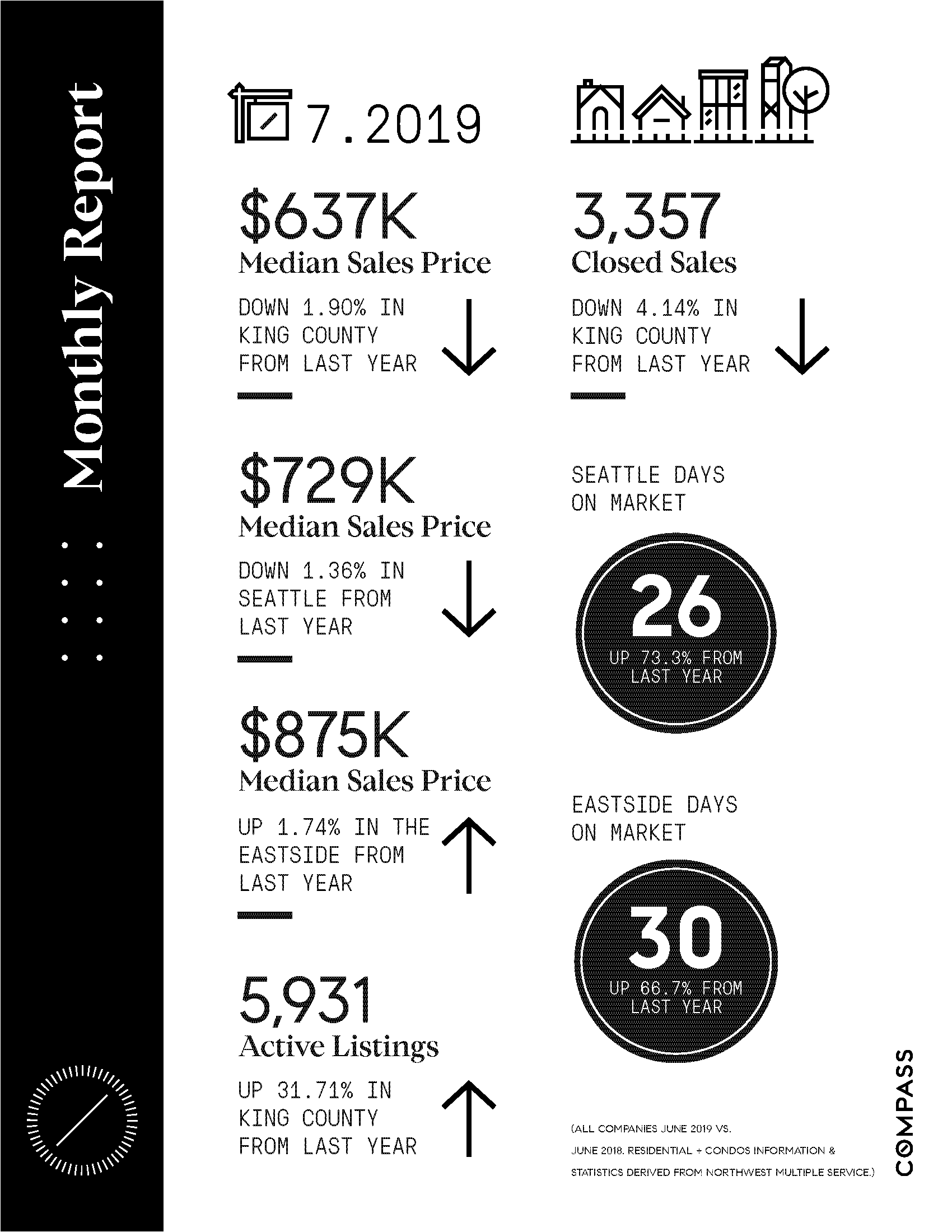

The July numbers are in, and our latest #MiniMarketReport is out. No lazy days of summer here—low interest rates, additional inventory, aggressive pricing, and sunny weather are bringing out buyers with closed sales remaining strong. Sellers: be thoughtful about pricing and presentation to achieve the best price for your home. Whether you’re looking to buy, sell, move up, or down, housing demand in our region remains strong, and an experienced agent can help ensure you have the pricing and marketing strategy to achieve your goals. Call me to find out how I can help you be successful in this market. #TipTuesday #MarketLeaders

Compass

Chris Doucet | July 2019 Monthly Market Report | The numbers are in!

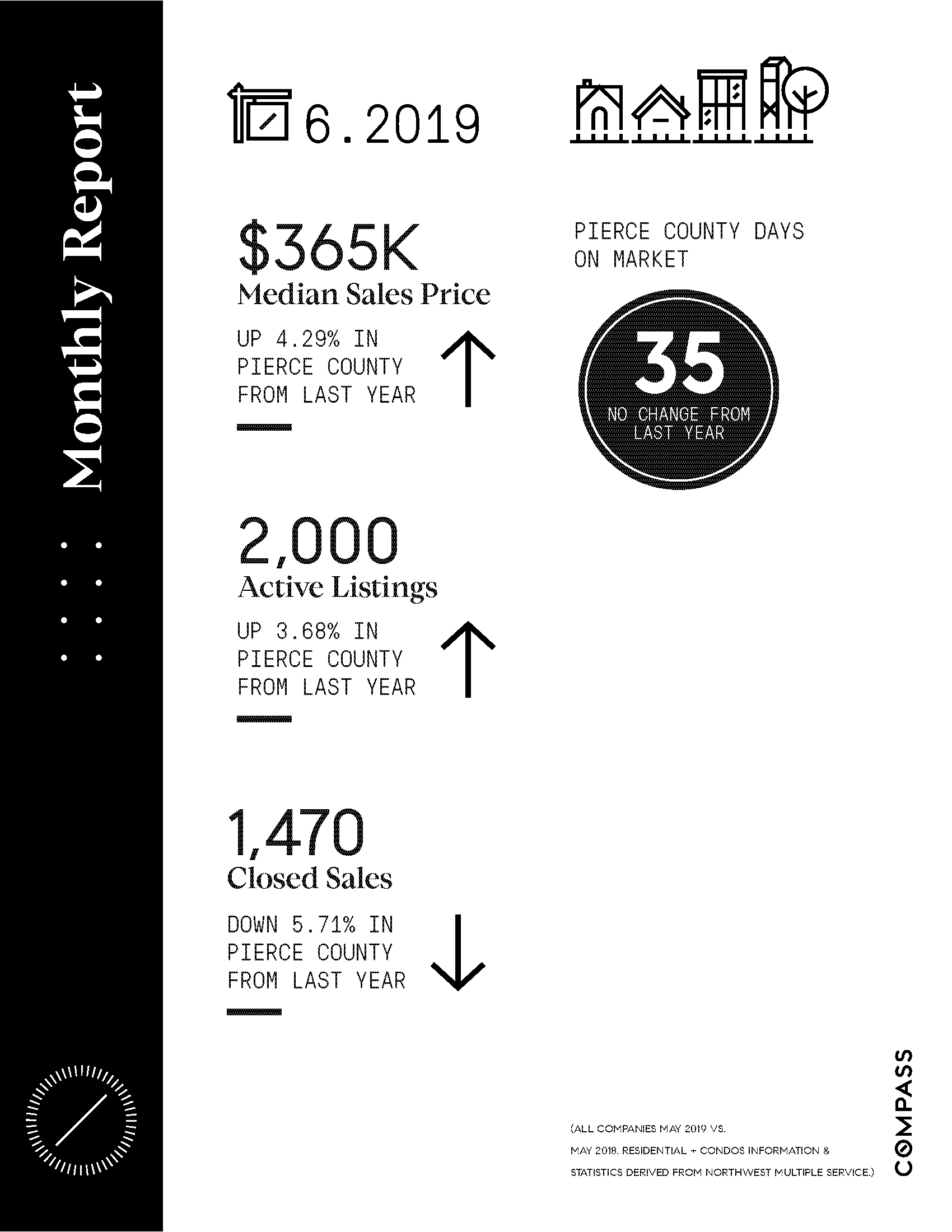

The June numbers are in, and our latest #MiniMarketReport is out! Our takeaway: the “new normal” is here to stay. With the number of available homes up in most areas compared to a year ago, buyers have more options and are being more deliberate with their decisions. For sellers, pricing and presentation are the two most important factors. The good news? Housing demand in our region remains strong, and an experienced agent can help ensure you are positioned correctly in today's market. Call me to find out how I can help you be successful in achieving your real estate goals. #MakeYourMove #MarketLeaders

Economist Todd Britsch from MetroStudy Puget Sound area

At our All Agent Compass Meeting on Tuesday, Economist Todd Britsch from MetroStudy gave us in the Puget Sound area (and Washington state as a whole) positive news about trends and

anticipated growth through 2021. Although our market is becoming more balanced with greater inventory available, our area continues to have huge growth and more buyers than sellers and interest rates make buying right now very attractive.

DID YOU KNOW? BOFA Chief Economist Michelle Meyer provided a great summary of the US economy worth sharing...

DID YOU KNOW?

Information provided by Compass Guru Leonard Steinberg

At yesterday's Compass/Bank Of America meeting, BOFA Chief Economist Michelle Meyer provided a great summary of the US economy worth sharing:

* It’s all about the FED.

* We are in the 10th year of the business cycle, the longest ever.

* Business cycles don’t end because of old age, they usually do so because of vulnerability or shocks.

* The only shock right now is the trade wars. This could shift the entire global mentality of our economy if they continue or expand.

* Confidence is down.

* Domestically oriented components are strong. Slightly weaker but strong. International markets are not as strong.

* The US consumer is super strong.

* Unemployment is strong.

* Housing shows some areas of price stretching, mostly on the west coast. Pricing in some areas may be a little too inflated.

* The backdrop is solid for housing.

* The economy still has room to grow still for the next 6-12 months.....except for the trade wars. They are a cloud over the economy.

* The upcoming G20 summit may reveal an agreement or direction to a resolution.

* So far most consumer goods have avoided tariffs....if that changes, all could be different.

* We are in the midst of the crosshairs.

* The Fed watches all this closely. Chances are rates will be cut to offset any risks imposed by tariffs. September is likely, possibly sooner. Low interest rates bode well for the housing market.

* The 10-year treasury rate is down 50% compared to a year ago.

Watch the following indicators:

1. The Labor market. Job creation is key. Last month showed dramatic slowing. Was it just a single month blimp?

2. Wage growth shows the ability of the consumer to spend.

3. What are the market signals? Right now stocks are high and bonds are low. The yield curve is inverted, indicating the bond market believes a recession is imminent.

Key takeaway: The last recession was unusual in that it affected the ENTIRE US housing market. Today, with much more banking and lending regulation the chances of that repeating are lessened considerably. Housing 'recessions' are much more localized based on local economies and supply/demand.

Market Report for June 2019 presented by Chris Doucet

Our latest #MiniMarketReport is out, and the name of the game for May was Momentum! With low interest rates, strong job growth, and brokers adding new listings to inventory, we saw a strong start to the peak season with brokers reporting busy open house traffic and increased activity. We predict a solid summer for both buyers and sellers; with the increased inventory, buyers have more choices so sellers should enter the market “show ready” with a solid marketing strategy in place. Reach out for more information on being successful in the summer market. #MarketLeaders