|

Eco-Friendly, Energy-Efficient Homes Attract Buyers

SOURCE: Keeping Current Matters

Are you planning to sell your house? If so, you may be surprised to hear just how much buyers value energy efficiency and eco-friendly features today. This is especially true as summer officially kicks off.

In fact, the 2023 Realtors and Sustainability Report from the National Association of Realtors (NAR) shows 48% of agents or brokers have noticed consumers are interested in sustainability.

So, if you’re considering selling your house, why does this matter to you? It helps you know what you can do to make your house even more appealing to today’s buyers. According to Jessica Lautz, Deputy Chief Economist and VP of Research at NAR:

“Buyers often seek homes that either lessen their environmental footprint or reduce their monthly energy costs. There is value in promoting green features and energy information to future home buyers.”

Consider Upgrading Your Home To Make It More Appealing

If you want to upgrade your house in a way that maximizes its green appeal, you need to work with a local agent to understand what buyers in your area are looking for. The same NAR report identifies the following green home features as most important to buyers at a national level:

Windows, doors, and siding

Proximity to frequently visited places

A comfortable living space

A home’s utility bills and operating costs

While you can’t change the location of your house, you can take action to make sure it’s as comfortable as possible while also setting up the next owners for lower operating costs. ENERGY STAR shares some suggested upgrades as ones that may be worth considering:

Heating and cooling: Ensure your HVAC system is properly maintained and regularly serviced to maximize its efficiency. Consider upgrading to a high-efficiency model, if needed.

Water heater: Your water heater uses a lot of energy. Upgrading to a heat pump water heater can significantly reduce energy consumption and appeal to environmentally conscious buyers.

Smart thermostat: A big part of your energy bill goes to heating and cooling. Install a programmable thermostat to better regulate temperature settings. This not only enhances comfort but can also lower energy usage.

Attic insulation: Proper sealing and insulation in your attic help prevent air leaks and maintain a comfortable temperature, reducing the strain on heating and cooling systems.

Energy-efficient windows: Replacing old, drafty windows with energy-efficient ones can minimize heat transfer and lower your energy bills.

It’s worth noting that you may be able to take advantage of tax credits and rebates for energy-efficient home installations and upgrades. These incentives could help offset a portion of the costs associated with eco-friendly home improvements.

As you prepare to sell your house, it’s important to recognize that real estate agents are valuable resources. They can help you determine which upgrades would be most appealing for buyers in your area and provide guidance on which green features to highlight in your listing. If you’ve already made these updates recently, tell your agent so they can feature them in your listing.

Bottom Line

Focusing on energy efficiency and eco-friendly features can help make your house more appealing to buyers today. Connect with me to ensure you’re choosing the right upgrades for your area.

SOURCE: Keeping Current Matters

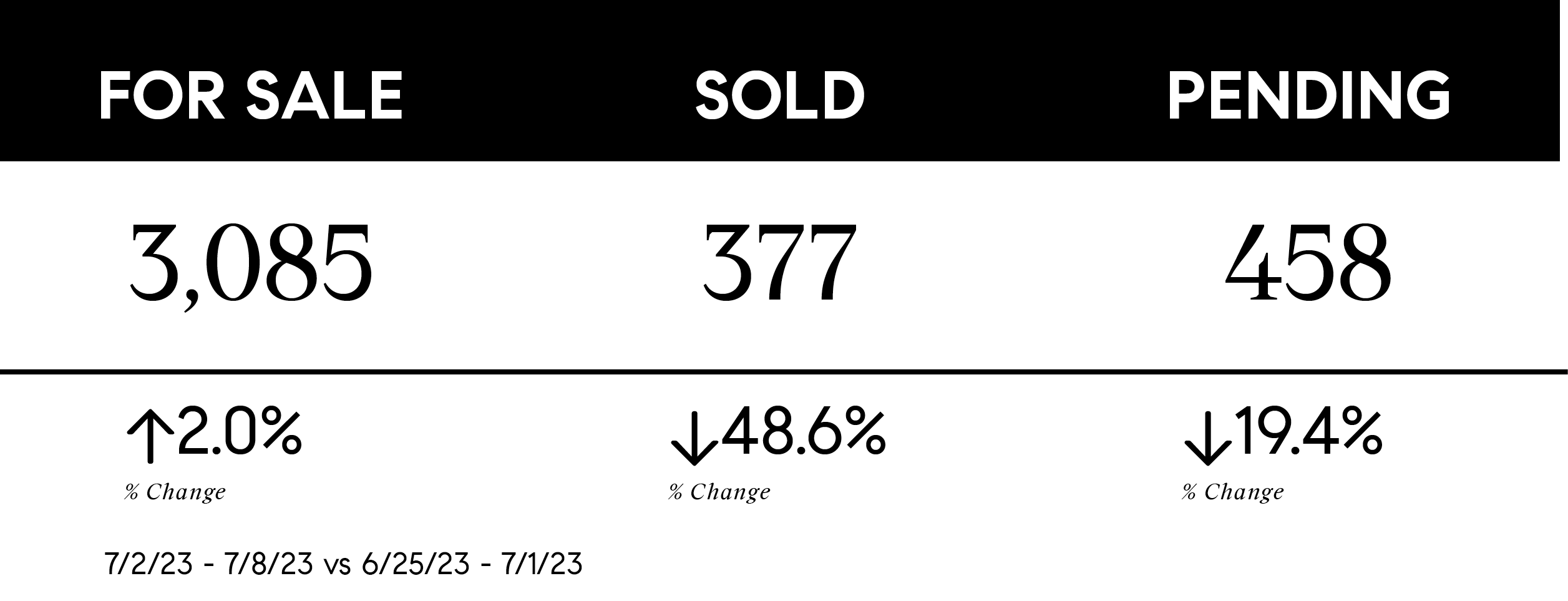

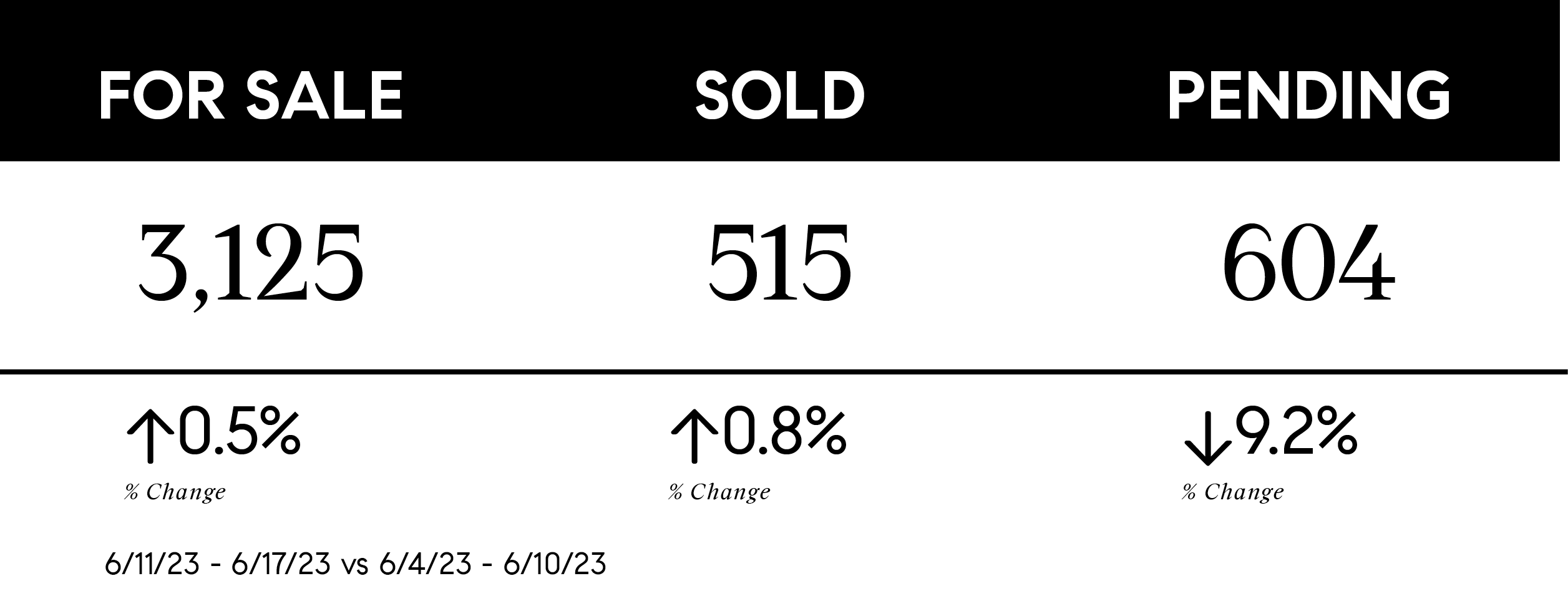

June 28, 2023 Weekly Market Watch with Chris Doucet

|

June 21, 2023 Weekly Market Watch with Chris Doucet

|

Everything You Need to Know About Loan Estimates

SOURCE: Freddie Mac

Receiving multiple loan estimates gives homebuyers a better idea of the amount of money they can borrow to purchase a home. Learn more about what loan estimates are and what you need to do to prepare before seeking them out.

What is a loan estimate

A loan estimate is a standardized three-page document that outlines the terms of a proposed loan. Your lender will prepare a loan estimate for you based on information provided in your loan application. The purpose of a loan estimate is to give you the details of a loan before deciding if the loan is right for you.

Before requesting a loan estimate, you should also gain a better grasp of your finances to see how much home you afford.

What information should be on loan estimate?

The form uses plain language and is designed to present information clearly to borrowers. While the loan estimate is not a binding agreement, it should provide an accurate picture of the loan terms your lender intends to offer if you decide to move forward with them.

When reviewing your loan estimate form, you should carefully review the following sections:

Loan Terms: Here you will find the total amount of the loan, the interest rate the lender is offering as well as the monthly principal and interest (the amount of money being borrowed in addition to the lender’s interest for lending out the funds, paid out monthly by the borrower).

Projected Payments: This section will give you an idea of your monthly payment, calculated for the length of the loan. Along with the total monthly payment amount, you will see a breakdown showing what portion goes to principal and interest, mortgage insurance and estimated escrow.

Loan costs and other costs: Loan costs include origination charges, application fee(s) and the underwriting fee. Also included are the other costs: taxes, mortgage insurance premiums, prepaid interest and property taxes.

Calculating cash to close: This section breaks down the itemized list of costs that you will need to cover to close your loan. This typically includes down payment, deposits, fees and funds from the borrower.

Comparisons: This section compares the loan terms to others and shows the potential savings provided by the lender’s loan offer.

Other considerations: Included in this section are a few additional options that the borrower can opt in or out of, depending on their preferences. Topics covered include appraisals, assumptions, homeowner’s insurance, late payments, refinancing and servicing.

Shop Around and Compare Loans

Loan estimates will include their expiration date at the top of the first page and are good for ten business days from the original issue date. Given the brief window, we recommend that you request multiple loan estimates from different lenders and shop around to narrow down your lending options.

Borrowers who compare multiple loan estimates are more likely to save money in the long run. Getting multiple estimates will allow to make a more informed decision before selecting a lender and/or loan product.

SOURCE: Freddie Mac