|

How To Make Your Dream of Homeownership a Reality

SOURCE: Keeping Current Matters

According to a recent Harris Poll survey, 8 in 10 Americans say buying a home is a priority, and 28 million Americans actually plan to buy within the next 12 months. Homeownership provides many financial and nonfinancial benefits, so that interest is understandable.

However, it’s unlikely all 28 million Americans will accomplish that goal in the coming year. Experts project a total of around five million homes will be sold in 2023. Why is there such a big difference? It’s partly because there can be challenges to buying a home.

In the same survey, when asked, “Which of the following are preventing you from pursuing homeownership at this time?”:

34% answered, “I don’t have enough saved for a down payment”

30% answered, “My credit score”

If you’re aiming to buy a home, here’s what you need to know to accomplish that goal.

Save for Your Down Payment

Your down payment is a big chunk of what you pay up front for your home. For most home purchases, buyers put down some amount of cash up front (a down payment) and then take out a loan (a mortgage) to pay for the rest.

It’s a longstanding myth that you need to pay 20% of the purchase price for your down payment. In reality, 20% down isn’t always required. In fact, according to the National Association of Realtors (NAR), today’s median down payment is 14% for the average buyer and just 6% for a first-time buyer.

Regardless of how much money you can save for your down payment, know there’s help available. A local lender can show you options to help you get closer to your down payment goal. Plus, there are even loan types, like FHA loans, with down payments as low as 3.5% for some buyers, as well as options like VA loans and USDA loans with no down payment requirements for qualified applicants.

Beyond assistance programs and different loan types, here are a few other tips to help you as you save for your down payment:

Remember to factor in closing costs. In addition to your down payment, closing costs are usually 2-5% of the home’s purchase price.

Maintain your savings. Your down payment shouldn’t deplete all your savings. It’s important to still have some money set aside for homeownership expenses after you move in.

Explore your options and lean on your trusted advisor for expert guidance. Do your research, ask questions, and look into the resources available for buyers like you.

Improve Your Credit Score

Your credit score is a number that indicates how financially reliable you are to lenders. A higher credit score usually means you’ll be able to borrow more money at a better interest rate. If your credit score is preventing you from getting an affordable mortgage, there are steps you can take to improve it. Here are two:

Pay your bills on time. When you pay your bills on time, your credit score improves. When you’re late, it takes a hit. One way to make paying your bills on time easier? Set up automatic payments when and where you can.

Mix it up. From auto loans, to credit cards, to mortgages – there are several different types of credit. And having a mix of them improves your credit score.

Bottom Line

If you want to purchase a home this year, contact me so you can start preparing.

SOURCE: Keeping Current Matters

3 Reasons Not To Buy Now (and why they are wrong....)

Many articles have been written recently about why it's not a good time to buy a home now. Here are the the most common themes and my argument against them:

1. Prices will come down!

This is possible, yes, and in some areas they have already. Timing 'the bottom' is always difficult. So if prices have come down, being able to select the best property at a fair price may still be better than buying what is left over once prices really hit bottom and the markets are much more competitive. With fewer buyers in areas, your ability to negotiate is stronger now (in several areas around 7%). If you're renting now at $4,000 per month, while buying would cost $5,000 per month, over three years you will have spent about $150,000 on rent (assuming 2% annual rent escalations). In those same 3 years you'll have grown your equity in the home, and benefitted from the mortgage interest and real estate tax deduction. What if you are wrong about prices coming down in a super-low inventory environment? What if they stay the same....or rise? All areas are different....

2. Rates are so high and heading higher!

This is true and they will probably go higher. And more than likely they will dip too over time. Securing financing now may be easier than later if bank requirements are tightened....or if you lose a job. Rates will rise and remain higher as long as inflation is higher....which also implies that everything needed to build a house including labor will cost more too. Combine construction down with a decade-plus of under-building: when the economy rebounds, the demand vs. supply ratios could be much, much worse, triggering price hikes and more multiple bidding over (higher)asking prices.

3. A recession is coming!!!!

That is a certainty, and it always is, but that may or may not happen a month from now, a year or several years from now. In a recession, unemployment usually rises, but even really bad recessions have about 10% unemployment which means 90% remain employed, earning and spending, and 100% of everyone continues living. Life does not stop in a recession. Growth slows and decelerates. Everyone has to live somewhere. Rents are high too. Demand to rent actually grows during most recessions. Recessions also usually deliver lower interest rates as the FED tries to stimulate more borrowing and growth.....which could allow you to refinance and lower your mortgage payments too.

Our obsession with short-term thinking and headline-making often delivers an enormous price at the expense of calm, rational thinking.

SOURCE: Leonard Steinburg

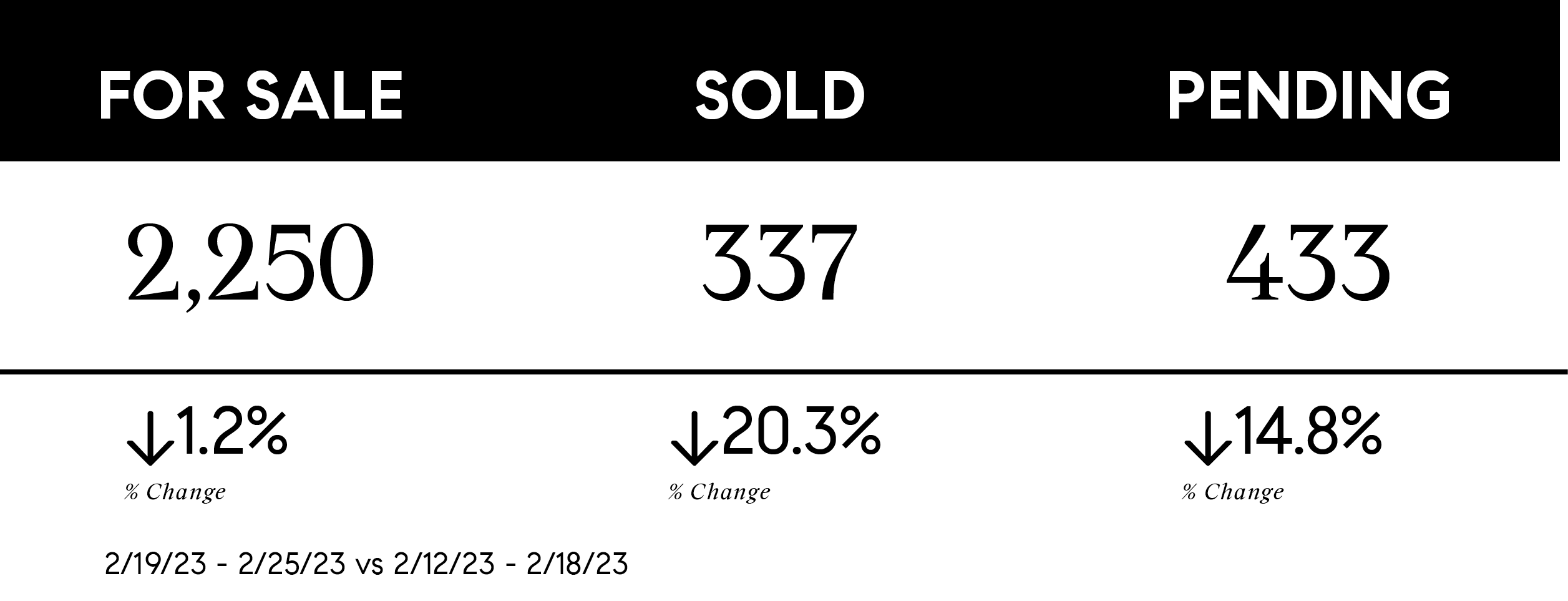

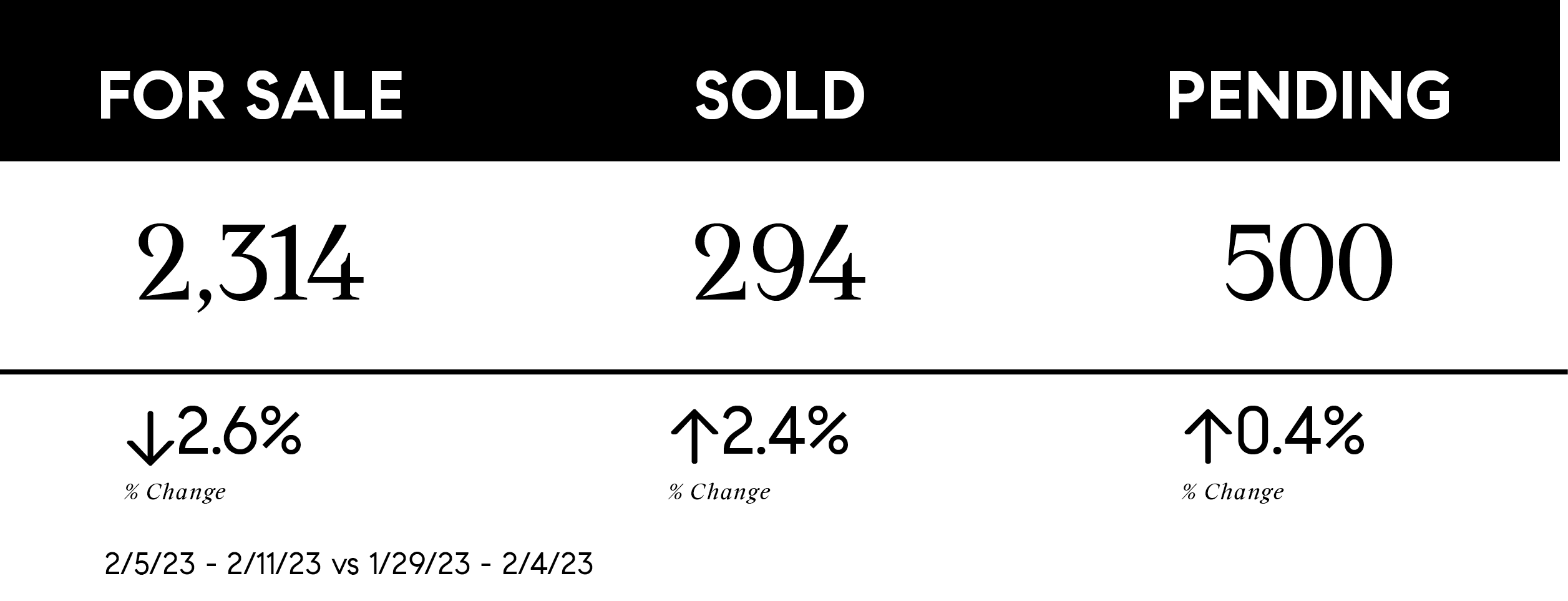

February 23, 2023 Weekly Market Stats with Chris Doucet

|

February 16, 2023 Weekly Market Watch with Chris Doucet

|